The US dollar (USD) and the Chinese renminbi are two of the world’s most widely used currencies. As the world’s two largest economies, the United States and China, both countries use their currency to trade with other countries and conduct international transactions.

The US dollar has been the world’s dominant currency since the end of World War II. It has been used as the international reserve currency, meaning that central banks around the world hold USD as a means of payment for international trade and investment. The Chinese renminbi, on the other hand, has only become a major international currency in the last few decades. Until 1994, it was pegged to the USD at a fixed exchange rate. However, China has since moved towards a more flexible exchange rate system, allowing the Renminbi to appreciate against the USD.

Renminbi (RMB) and yuan are two terms that are often used interchangeably to refer to the Chinese currency. However, there is a slight difference between the two terms.

Renminbi, which translates to “people’s currency” in English, is the official name of the currency used in China. Yuan, on the other hand, is a unit of the renminbi currency. It is the basic unit of the currency and is used to express the value of goods and services in China.

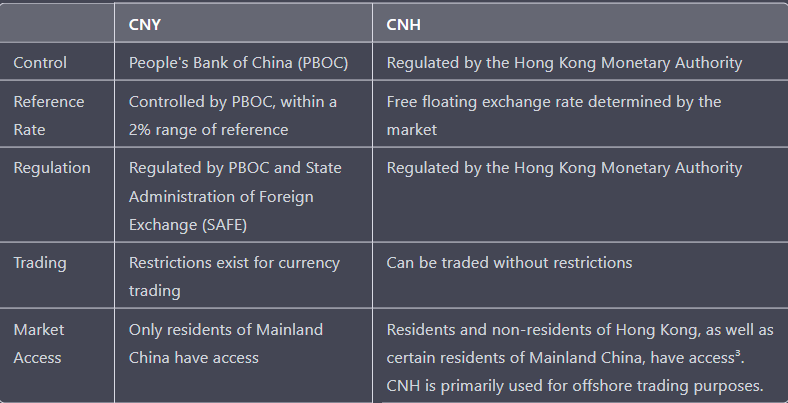

There are two types of Renminbi, which implies two types of Yuan: CNY and CNH. CNY is the Chinese Yuan that is traded within the country’s borders, while CNH is the Chinese Yuan that is traded offshore. While CNY and CNH have the same value in Renminbi, they are distinct currencies that are subject to different levels of regulation and restrictions and are traded at different prices. CNY is regulated by the People’s Bank of China, while CNH is regulated by the Hong Kong Monetary Authority. Despite some similarities, they are not the same currency.

Before 2005, the yuan was fixed to the US dollar at a rate of 8.27 yuan per USD but was then revalued to 8.11 yuan/USD. China has been gradually promoting the international use of the yuan by making foreign trade in the currency more efficient and flexible. Since 2006, the renminbi has been operating under a managed floating exchange rate system. Its value is based on a basket of currencies and allowed it to fluctuate within a narrow range. However, the exchange rate is reset daily based on supply and demand, with the central bank setting a daily reference rate that allows the currency to move within a 4% band around the reference rate, ignoring the previous day’s trading activity. Over the next three years, the yuan was allowed to appreciate by about 21% to a level of 6.83 to the dollar. In July 2008, China halted the yuan’s appreciation as worldwide demand for Chinese products slumped due to the global financial crisis. In June 2010, China resumed its policy of gradually moving the yuan up, and by august 11,2015, the yuan had appreciated by 33% against the US dollar . On August 11, 2015, the People’s Bank of China (PBOC) surprised markets with three consecutive devaluations of the Chinese yuan renminbi (CNY), knocking over 3% off its value. After a decade of steady appreciation against the U.S. dollar, investors had become accustomed to the yuan’s stability and growing strength. The drop amounted to 4% over the subsequent two days. Stock markets in the U.S., Europe, and Latin America also fell in response to the yuan devaluation. Most currencies also reeled. It is speculated that the devaluation was done as a desperate attempt to stimulate China’s sluggish economy and keep exports from falling further, as the devaluation occurred just days after data showed a sharp fall in China’s exports—down 8.3% in July 2015 from the previous year. However, PBOC claimed that the devaluation’s purpose was to allow the market to be more instrumental in determining the yuan’s value more believable. The PBOC stated that this was a one-off devaluation and the move was intended to bring the yuan’s central parity rate closer to market rates, allowing the market to play a greater role in determining the exchange rate. The ultimate goal was to deepen currency reform and make China’s currency system more market-oriented. this was in line with the Chinese Republican party pledge to make the renminbi a global reserve currency after the International Monetary Fund (IMF) added the yuan to its Special Drawing Right basket on Oct. 1, 2016. This basket initially included the euro, Japanese yen, British pound, and U.S. dollar. The SDR is an international reserve asset that IMF members can use to purchase domestic currency in foreign exchange markets to maintain exchange rates. The IMF reevaluates the currency composition of its SDR basket every five years. In 2010, the yuan was rejected on the basis that it was not freely usable. The IMF welcomed the devaluation, encouraged by the claim that it was done in the name of market-oriented reforms. Consequently, the yuan became part of the SDR. After this yuan stabilized and was contained between 6 yuan/dollar and 7 yuan/dollar. With the little variation caused due to various factors like –

However, PBOC claimed that the devaluation’s purpose was to allow the market to be more instrumental in determining the yuan’s value more believable. The PBOC stated that this was a one-off devaluation and the move was intended to bring the yuan’s central parity rate closer to market rates, allowing the market to play a greater role in determining the exchange rate. The ultimate goal was to deepen currency reform and make China’s currency system more market-oriented. this was in line with the Chinese Republican party pledge to make the renminbi a global reserve currency after the International Monetary Fund (IMF) added the yuan to its Special Drawing Right basket on Oct. 1, 2016. This basket initially included the euro, Japanese yen, British pound, and U.S. dollar. The SDR is an international reserve asset that IMF members can use to purchase domestic currency in foreign exchange markets to maintain exchange rates. The IMF reevaluates the currency composition of its SDR basket every five years. In 2010, the yuan was rejected on the basis that it was not freely usable. The IMF welcomed the devaluation, encouraged by the claim that it was done in the name of market-oriented reforms. Consequently, the yuan became part of the SDR. After this yuan stabilized and was contained between 6 yuan/dollar and 7 yuan/dollar. With the little variation caused due to various factors like –

- Economic Growth: Economic growth in both the US and China can impact the exchange rate. If China’s economy grows faster than the US, demand for CNY may increase, causing its value to appreciate against the USD.

- Trade Balance: The trade balance between the two countries can also affect the exchange rate. If China exports more goods to the US than it imports, it will accumulate more USD, which can put downward pressure on the CNY. Conversely, if China imports more goods from the US than it exports, it will accumulate more CNY, which can put upward pressure on the currency.

- Monetary Policy: Monetary policy decisions by the US Federal Reserve and the People’s Bank of China can also impact the exchange rate. Changes in interest rates or other monetary policy tools can affect the value of the USD and CNY relative to each other.

this recognition by IMF gave china various benefits like increased international contracts priced in yuan, which reduced its reliance on the US dollar and mitigated exchange rate risks and transaction costs. Furthermore, central banks were required to hold yuan as part of their foreign exchange reserves which boosted demand for the currency and lowered interest rates for yuan-denominated bonds. This resulted in lower borrowing costs for Chinese exporters and strengthened China’s economic clout relative to the United States, supporting President Jinping’s economic reform agenda.