The corona pandemic has claimed many lives across the world. It’s other side effects include the widespread rampage on all sectors of economy of the world. It has caused the closure of many small industries, businesses and enterprises and it continues to haunt the future of not only SMEs(Small and Medium Enterprises), MSMEs (Micro Small Medium Enterprises), Microfinance Institutions but also big companies.

In view of this, big Chinese banks, Private Equities and other multilateral instruments are investing heavily in such falling companies. These Chinese corporations work under the beneficial owner; the government of China. China’s recent increase in investment in HDFC bank has exceeded 1% which has poked the bear (RBI) into looking into this matter.

ATTRACTING INVESTORS IS GOOD, SO WHATS THE PROBLEM?

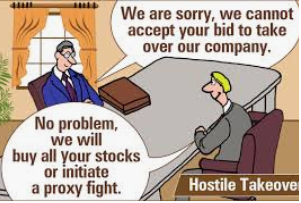

The problem is that by investing heavily they are buying shares of these companies at “THROWAWAY PRICES”. The impact of this, is that they will be majority stakeholders of these companies or aim to attempt buying them eventually (“HOSTILE TAKEOVER”). This will give them power to control these businesses and help them direct profit money to China.

China currently invests around $4 billion in Indian startups.18 out of 30 Indian unicorns (startups having more than $1 billion market capitalization) have Chinese funding.Big investors from China -Alibaba, Tencent , ByteDance have made huge investments in Paytm, Byju’s , OYO, Ola, Big Basket, Swiggy, Zomato. China dominates Indian markets in pharmaceutical APIs(Active Pharmaceutical Ingredients), mobile phone markets, automobiles and electronic and project imports.

HOW IS THE DRAGON’S MARKET INVASION BEING STOPPED?

The Government of India and RBI (Reserve Bank of India) lost no time in rectifying it’s policies.The government has decided to screen Foreign Direct Investments (FDI) from countries sharing a land border with India or where the beneficial owner of an investment into India is situated in or is a citizen of any such country. The capital market regulator of India ,SEBI (Securities Exchange Board of India) is also digging deeper into Foreign Portfolio Investors(FPI) composition from China, by seeking beneficiary details from jurisdictions like Mongolia, Bhutan, Nepal, Bangladesh , Afghanistan and Yemen.

SO WHAT’S NEXT?

These policy changes have put an end to such hostile takeovers yet other measures need to be taken in order to mitigate China’s sway over the market.